Homeowners Insurance 101: Understanding Coverage for Natural Disasters and More

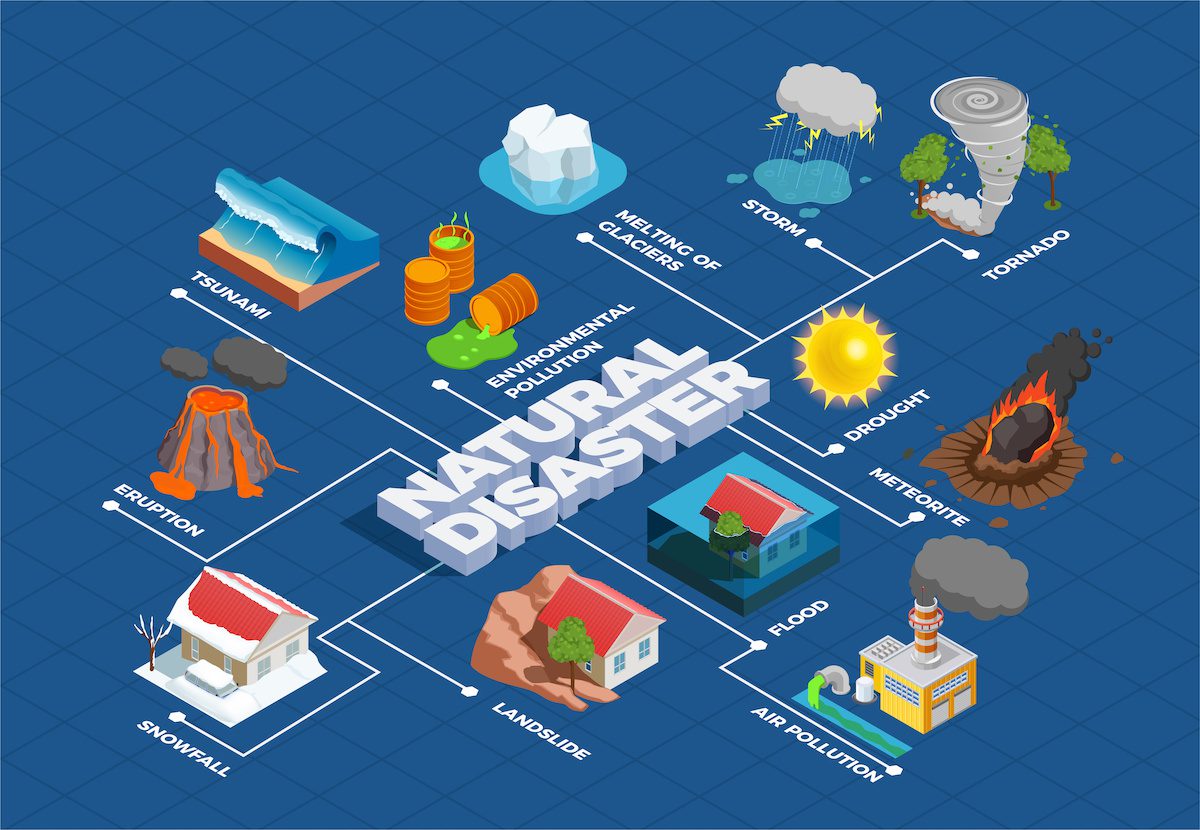

When it comes to protecting your home and belongings, homeowners insurance is an essential policy. It provides financial protection in case of accidents, theft, or damage to your property. However, one of the most critical aspects of homeowners insurance is its coverage for natural disasters. Earthquakes, floods, hurricanes, and other natural events can cause significant damage to your property. Understanding how homeowners insurance works in these situations, and what it covers, is crucial to ensuring that you’re adequately protected. In this article, we’ll explore the ins and outs of homeowners insurance with a particular focus on natural disaster coverage, how to get the right home insurance quote, and how it compares to other types of coverage like auto insurance.

What is Homeowners Insurance?

Homeowners insurance is a policy that covers your home, personal belongings, and liability in case of unexpected events. It typically includes several types of coverage:

- Dwelling coverage: Protects the structure of your home in case of fire, wind, or vandalism.

- Personal property coverage: Protects your belongings, such as furniture, clothing, and electronics, in case they are damaged or stolen.

- Liability coverage: Provides financial protection if someone is injured on your property and sues you for damages.

- Additional living expenses: If your home becomes uninhabitable due to damage, this coverage helps with living expenses, such as temporary housing.

Natural Disasters and Homeowners Insurance Coverage

One of the most crucial factors in homeowners insurance is understanding how it handles natural disasters. Depending on where you live, your property could be at risk for several types of natural events. Home and auto insurance providers often offer coverage for common events like fires and storms, but certain disasters may require additional policies or riders. Let’s break down some common natural disasters and what’s typically covered by homeowners insurance.

1. Hurricanes and Windstorms

Hurricanes and other windstorms can cause severe damage to homes, particularly in coastal areas. Homeowners insurance generally covers damage from wind and hail, including roof damage, broken windows, and siding damage. However, it’s important to note that flood damage is not typically included in a standard homeowners insurance policy.

If you live in a hurricane-prone area, you may need to purchase flood insurance separately through the National Flood Insurance Program (NFIP) or private insurers. Flooding is often the most expensive damage caused by hurricanes, so having this coverage in place can save you a significant amount of money in the event of a disaster.

2. Earthquakes

Earthquakes are another natural disaster that is not typically covered by standard homeowners insurance. If you live in an area prone to earthquakes, you will need to purchase a separate earthquake insurance policy. Earthquake coverage typically helps with structural damage to your home and personal belongings, but it may not cover damages to other structures like garages or fences.

It’s essential to check with your home and auto insurance provider to find out if they offer earthquake insurance or if you need to secure a separate policy from a specialized insurer.

3. Wildfires

Wildfires are a significant risk in areas with dry climates, such as the western United States. Fortunately, homeowners insurance usually covers damage caused by wildfires. This includes damage to the structure of your home, as well as personal property inside your home. However, there may be limits on coverage for items outside of your home, such as trees, fences, or other outdoor structures.

If you live in a high-risk wildfire area, it’s important to ensure that your policy covers enough of the potential damages. Some insurers may impose specific conditions or restrictions on wildfire coverage, so always review your home insurance quote carefully.

4. Tornadoes

Tornadoes are covered by most homeowners insurance policies as part of the windstorm coverage. This means that any damage caused by a tornado’s winds to your home and personal property will typically be covered under your policy. However, like with other wind-related disasters, flood damage caused by a tornado’s aftermath (such as heavy rain and flooding) would not be covered unless you have separate flood insurance.

Tornadoes can cause significant property damage in a short amount of time, so ensuring you have comprehensive coverage for such events is essential. Always request a house insurance quote that includes protection against windstorms and other severe weather.

5. Floods

Floods are one of the most damaging natural disasters, but they are not covered by standard homeowners insurance. This means that if your home is affected by flooding due to heavy rains, rising rivers, or other causes, your homeowners insurance will not pay for repairs or replacements. To protect yourself from flood damage, you must purchase a separate flood insurance policy.

Flood insurance can be obtained through the National Flood Insurance Program (NFIP) or private insurance companies. If you live in a flood zone, you may be required to carry flood insurance by your mortgage lender.

How to Get the Best Homeowners Insurance for Natural Disasters

When shopping for homeowners insurance, it’s essential to ensure that your policy covers the specific natural disasters that are most likely to affect your area. Here are a few steps to help you secure the best coverage for your needs:

1. Evaluate Your Risks

The first step in finding the right homeowners policy is assessing the natural disaster risks in your area. Consider whether you live in an area prone to hurricanes, earthquakes, floods, or wildfires. Research the frequency and severity of natural events in your region so that you can make an informed decision about which coverages you need.

For example, if you live in an earthquake-prone area, earthquake insurance is a must. Similarly, if you live in a coastal region, flood insurance may be necessary to protect your home and belongings.

2. Request Multiple Quotes

When looking for affordable home insurance, it’s a good idea to compare home insurance quotes from multiple providers. Insurance companies offer varying rates and coverage levels, and comparing quotes can help you find the best deal. Look for insurers that offer comprehensive natural disaster coverage as part of their homeowners insurance policies.

If you are bundling your auto insurance with your homeowners insurance, this may provide additional discounts and savings. Many auto and home insurance companies offer package deals that can help lower your premiums.

3. Check for Additional Riders

Some natural disasters, like floods or earthquakes, may not be covered by standard homeowners insurance policies. However, you can often add riders to your policy for additional coverage. A rider is an endorsement that modifies your policy to provide extra protection for specific events.

For example, you can add a flood rider or an earthquake rider to your policy to ensure you have comprehensive coverage for these events. Riders are usually purchased at an additional cost, but they can provide peace of mind if you live in a high-risk area.

4. Review Your Deductibles and Limits

When reviewing your home insurance quote, make sure to pay attention to your deductible and policy limits. Your deductible is the amount you’ll pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premiums, but make sure you can afford the deductible if you need to file a claim.

Similarly, review your coverage limits to ensure they’re sufficient to cover the cost of repairs or replacement in the event of significant damage. In disaster-prone areas, it’s essential to have enough coverage to rebuild your home and replace damaged personal property.

How Homeowners Insurance Compares to Auto Insurance

While homeowners insurance covers your property, auto insurance protects your vehicle in case of accidents, theft, or other damage. Though both types of insurance serve different purposes, you can often save money by bundling home and auto insurance policies together.

When shopping for car insurance quotes, it’s important to consider the same factors as with homeowners insurance—the coverage, the exclusions, and the cost. Car insurance companies offer different levels of coverage, such as liability, collision, and comprehensive coverage. When bundling your home insurance with auto insurance, you may receive discounts, and the convenience of managing both policies under one provider can save time and money.

Temporary Car Insurance

If you don’t need year-round coverage for your vehicle, temporary car insurance can be an affordable solution. It’s ideal for those who only need coverage for a short period, such as when renting a car or borrowing a vehicle. Just like with home insurance, it’s important to ensure that you have the right level of coverage, even if it’s temporary.

Conclusion

Understanding your homeowners insurance and its coverage for natural disasters is crucial to protecting your property and personal belongings. Different types of disasters require different policies or additional riders, so make sure your home insurance quote includes the right protection for your needs. Whether you’re shopping for flood insurance, earthquake coverage, or windstorm protection, always evaluate your risks, compare quotes, and ensure your policy provides comprehensive coverage.

If you already have auto insurance, bundling it with your home and auto insurance policies can lead to significant savings. By working with trusted auto and home insurance companies, you can secure the best car insurance and affordable home insurance for your needs, offering protection for both your home and your vehicle under one policy.

For more information visit the following sites: